In an earlier post I introduced the concept of the Mobile Data User’s Hierarchy of Needs and its limiting impact on mobile subscribers’ consumption of content – particularly audio. And now another year has passed and with it another season of dismal reports about the inability of streaming audio services to transform themselves into profitable enterprises. Once again investors and market watchers are scratching their heads as the market sends confusing signals as to what models are working. None of them are.

The Mobile Data User’s Hierarchy of Needs

Mobile streaming audio services are in trouble – they’ve unnecessarily limited their offerings to reach only digital smartphone platforms to the exclusion of the larger install-base. In doing so they now unwittingly compete not just against other streaming audio providers but also against social, games, email and video – on what is not a level playing field. It costs nothing for users to download and register with most audio streaming apps. This explains the high awareness and impressive registration figures reported by the likes of iHeartRadio and Pandora. But possession of an app doesn’t translate to usage. In that way a smartphone is a lot like a Swiss army knife with infinite features (apps) but few you actually ever use.

Users paying a premium for broadband data will by nature opt for screen-intensive and social apps; audio doesn’t offer the same adrenaline rush and gets forgotten in the second or third screen of apps. The outcome? As reported recently by Christina Warren at Gizmodo, audio streaming services are losing the competition for consumer interest and revenues.

Why hasn’t this been working? Simple…all of these app-centric solutions were born of the technology industry with lessons learned from Internet business models. If you were going to introduce a new audio content distribution platform, would you take your lessons from the Internet, or from Radio? Would you target only display-centric compute-capable devices held by a subset of prospective listeners, or would you target devices with an install-base that rivals radio?

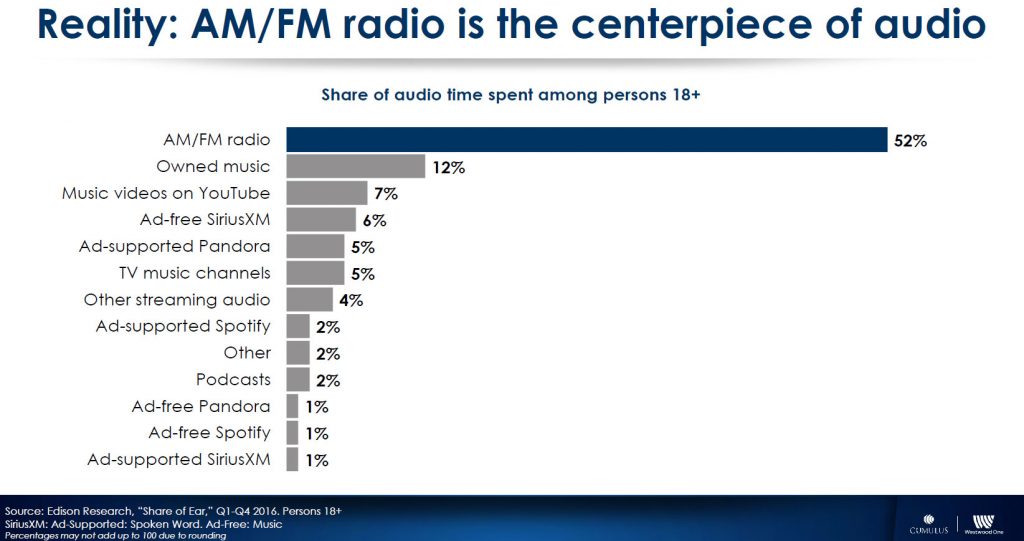

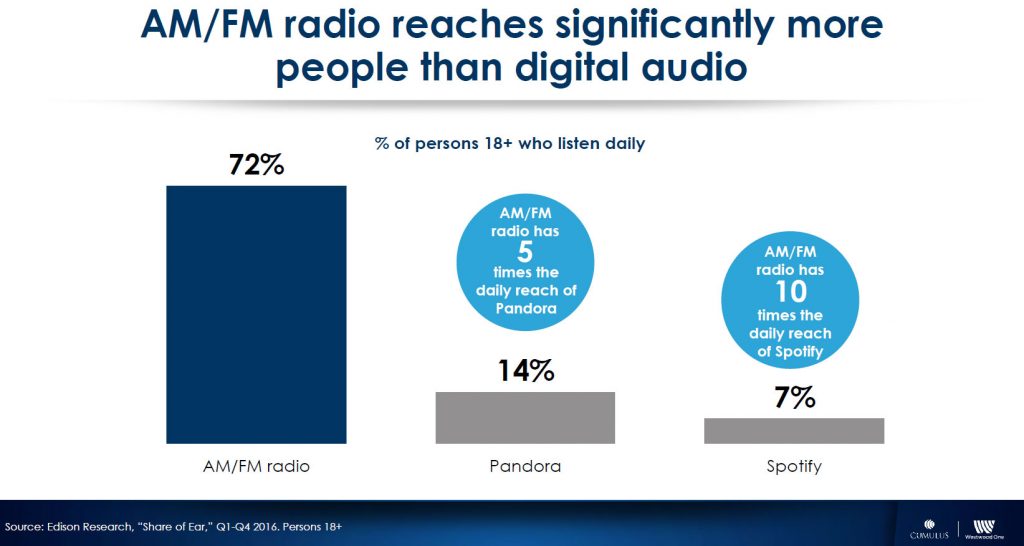

Let’s stop the madness and look at what is working with radio and what isn’t working for streaming audio, courtesy of Edison Research and Westwood One and their annual “Share of Ear” study into consumer audio consumption. What can streaming audio providers learn from terrestrial radio? More specifically, if you have a potentially superior service, what lessons can be taken to accelerate interest, trial and adoption?

To begin you need to accept the Mobile Data User’s Hierarchy of Needs and its implications for consumer consumption of mobile data. Not to get redundant, but all lessons are better understood if you first grasp and accept that smartphones with video displays, apps and a premium fee for mobile data usage also create conditions favoring video and social to audio consumption.

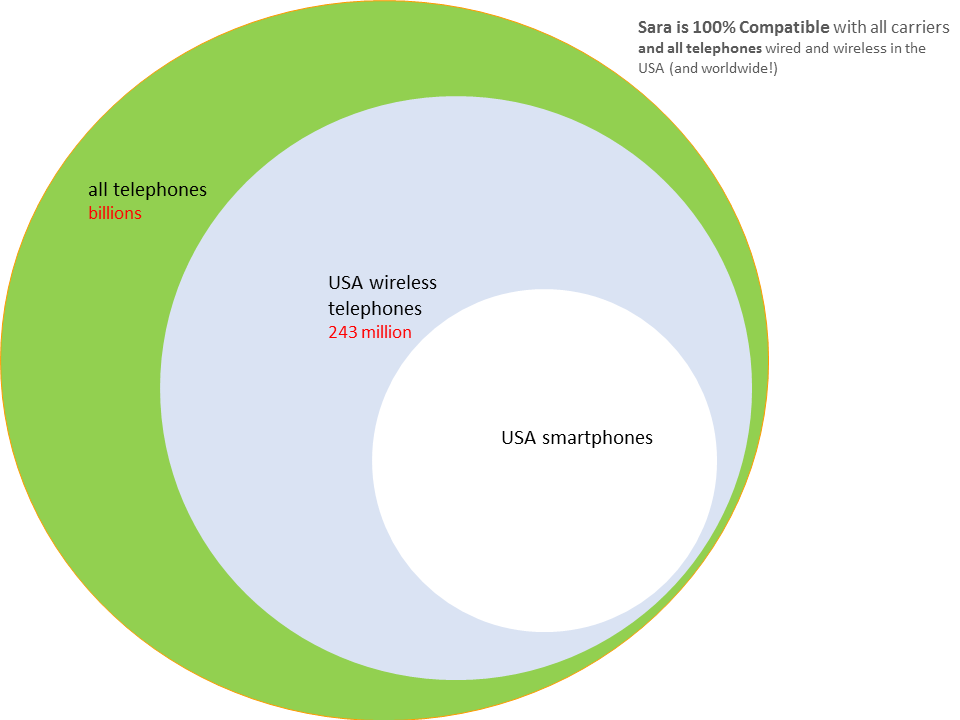

Radio remains the most sought after mobile audio platform

The next step is the realization most audio is consumed outside the home, and that smartphones exclude most of this prospective audience. In a future article I’ll delve directly into the misinformation regarding the true number of smartphone users vs. active device subscriptions, but for now let’s accept that there are far fewer smartphone users than total telephony users, and there are as many telephony users as there are radios and radio listeners. Radio is everywhere. Are you following the logic? Why aren’t streaming audio services planning to displace Radio, instead of being satisfied to be just another app on a phone, or disused tool on the Swiss army knife?

The most successful platform for mobile audio remains radio. More than one hundred years after its introduction to the world, Radio remains massively successful because of fundamental factors that any audio provider would be wise to emulate:

- Pervasive

- Easy

- Familiar

- Friendly

- Instantaneous

- Standardized

- New device not required

- Passive listener friendly

- No downloads

- Piracy-proof

How can mobile audio streamers compete with such low reach?

Smartphone apps simply miss the mark on most of these. Wouldn’t it make a lot more sense for mobile audio to emulate these features of radio, rather than compete against video, email, texting, games and social media combined? Wouldn’t the most logical platform to target mobile consumer audio be the one with a device penetration that rivals radio and requires no learning curve to adoption and use? This truly level playing field for competition exists and it is called voice telephony.

Radio remains massively entrenched to the population because it is widely accessible without hurdles to adoption and without risk of exhausting one’s data allowance. By diverting streaming audio consumption to the audio-optimized voice line we resolve the conundrum of the Mobile Data User’s Hierarchy of Needs and create new access points to interactive audio for those subscribers using feature phones or smartphones without data plans – essentially doubling-to-tripling the immediate prospective audience available to discover mobile streaming audio for the first time. Instead of mobile streaming audio being relegated to a small segment of smartphone users, it becomes immediately accessible to anybody with any phone. Refer back above to the list of features making radio successful… delivering mobile audio using the voice connection ticks all of these success factors.

The audience for mobile streaming audio is self-limiting

The mobile telephone is a two-way radio. It transmits as well as receives, which makes it an interactive device, which conventional radio is not. The technology of SaraConnects is designed to instantly transform any telephone into a smart, personalized interactive radio. Access requires only a dialed telephone call or text. No apps, no data, no gigs, no restrictions or hurdles to trial. Sara’s artificial intelligence is optimized for audio and voice and designed for rapid deployment. Streaming Audio Services – are you listening? https://saraconnects.world/contact